We develop management skills and learn theories to solve problems, that we will have in future. This article contains the main information, that was in the book.

Entrepreneurial perspective

Entrepreneurship is an Essence of business. It comprises 3 things: innovativeness, risk taking and management skills. These qualities can be learnt, or be the talent.

The¬†innovative process is a¬†process of¬†‚Äúcreative destruction‚ÄĚ.

Henry Ford¬†‚Äď not¬†engineer, but¬†innovator.

He made a¬†car ‚ÄúTin Lizzy‚ÄĚ for¬†ordinary people for¬†$295*25 in¬†our currency. He established franchising system of¬†car shops, petrol stations and¬†promoted highway infrastructures.

The average worker worked 8 hours a day and gained $5 for that ($135 now). The work was safe.

Till 1927 he sold 15m cars, but GMC was more innovative and Ford lost in future.

Ray Kroc¬†‚Äď milkshake seller made a¬†franchise out of¬†a¬†small restaurant.

Dick and Mac McDonald offered cheap and tasty burgers.

Kroc just implemented a conveyer system and optimized the kitchen area.

In 2000’s subway outperformed McDonald’s, because they made healthy food.

Dietrich Mateschitz¬†‚Äď brought Red Bull from Thailand to¬†Austria.

He had 49% of company, while Thai partner had 51%.

Red Bull is a¬†sport sponsor and¬†has¬†‚ā¨6b in¬†revenues.

Has hundreds of competitors.

Jobs¬†‚Äď Apple, Pixar, NeXT.

Best advertiser ever.

He was kicked out after successful projects, but¬†became an¬†intrapreneur¬†‚Äď entrepreneur in¬†a¬†company. He made Macintosh, but¬†was fired and¬†opened company NeXT, and¬†also sponsored Pixar¬†‚Äď P.S. he did not¬†invent Pixar, he just was the¬†main investor.

‚ÄúA¬†lot of¬†times, people don‚Äôt know what they want until you show it to¬†them‚ÄĚ

What is in common?

- Idea or vision. How to do better?

- They weren’t engineers, they just implemented marketing, design...

- Work hard for the goal

- Content-related goals (e. g. produce cheap and good cars)

- Profit is on the second place

- Plenty customers who is ready to pay

- Risk of failure

Motives

- Create something and make an impact

- Independence or autonomy

- Wealth and fame

Theory of entrepreneurship explains:

- How company grows from startup to enterprise

- How business helps the national economy

- Why businesses fail

- How to create a suitable environment for business (VC, Angels etc)

- Why after a growth, companies loose their positions

Joseph Schumpeter¬†‚Äď Austrian pioneer of¬†the¬†theory of¬†entrepreneurship

Joseph defines dynamic entrepreneur or pioneer as the engine that is driving a progress. Pioneer develops new processes or products. by doing that, he takes an advantage over competitors or creates a new market (blue ocean). But other companies try to imitate or copy the idea of a pioneer. This is called Dynamic competitive process.

When another pioneer will bring a¬†new idea, the¬†old pioneer‚Äôs idea will be destroyed. It is a¬†Process of¬†creative destruction. The¬†last type is a¬†Recombinant Innovation¬†‚Äď when a¬†new idea is a¬†combination of¬†existing ideas.

Entrepreneurial behavior is often ‚Äúirrational‚ÄĚ, rather intuitive. Pioneer‚Äôs idea is innovative, because it breaks old patterns. To¬†increase chances to¬†be successful, we need a¬†business plan.

Business plan shows us an overall concept of a business idea for investors, shows chances and risks, helps to think about further development of business, identifies threats and protects you from overconfidence and wonders.

Disruptive innovation displaces an existing technology.

Business model innovation does not change a product, but a logic of a business plan.

For example: Netfilx displaced video stores, Uber changed a business model of taxi companies.

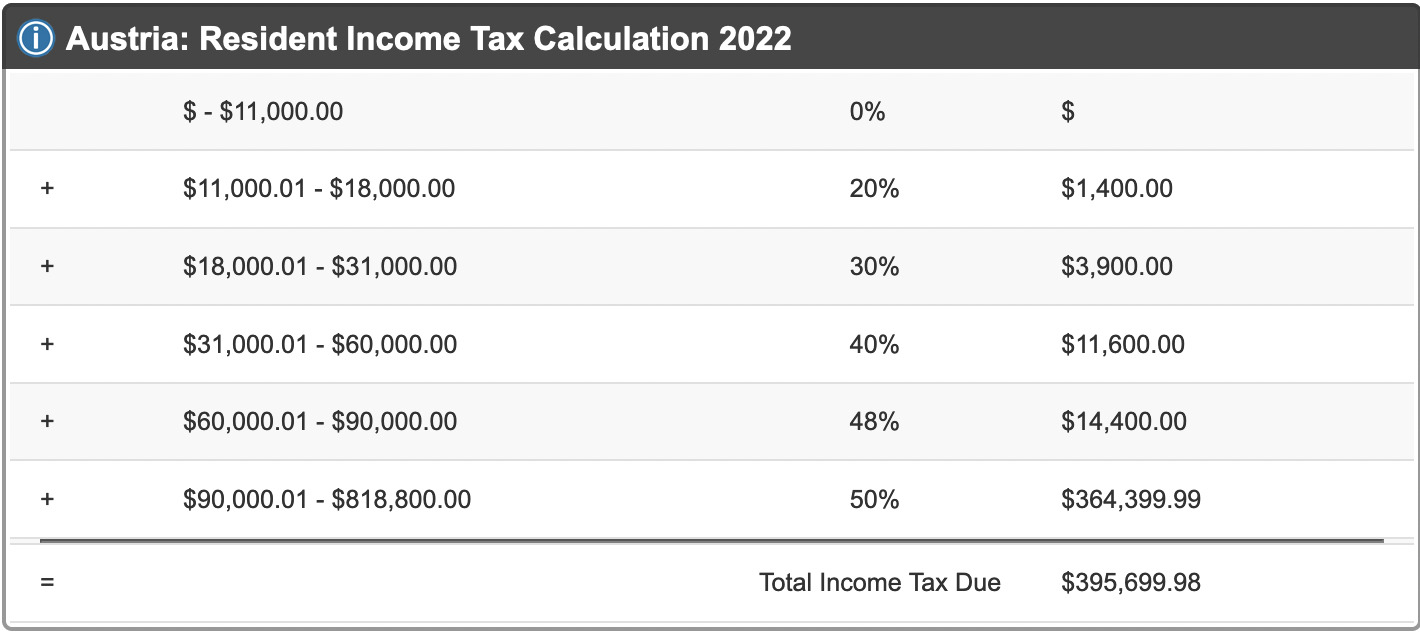

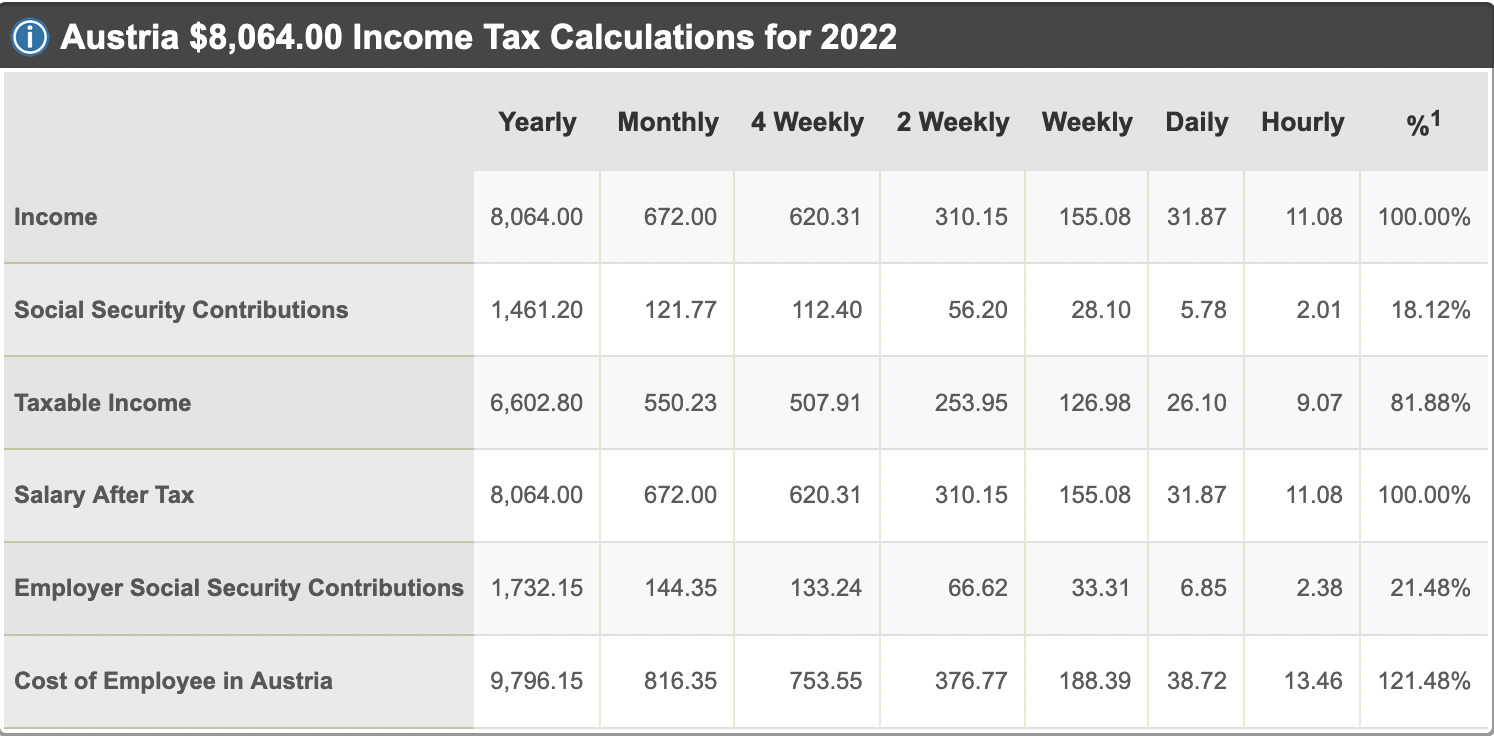

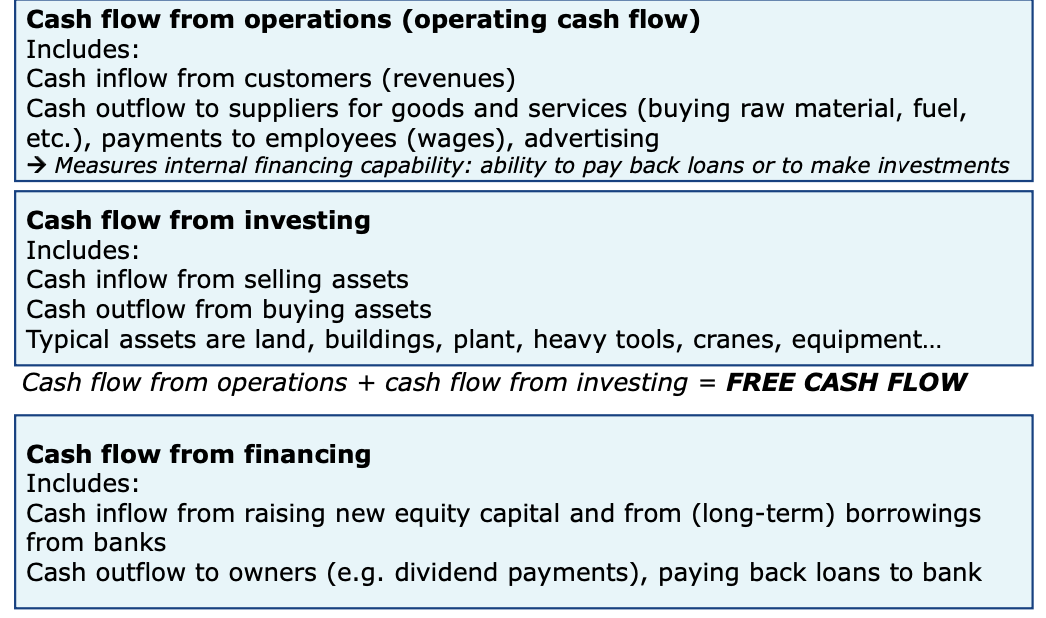

Financial perspective

How much money do you earn or¬†loose?¬†‚Äď How to¬†measure financial business performance? What is a¬†value of¬†a¬†company? How to¬†ensure liquidity and¬†solvency? How to¬†decide on¬†investments?

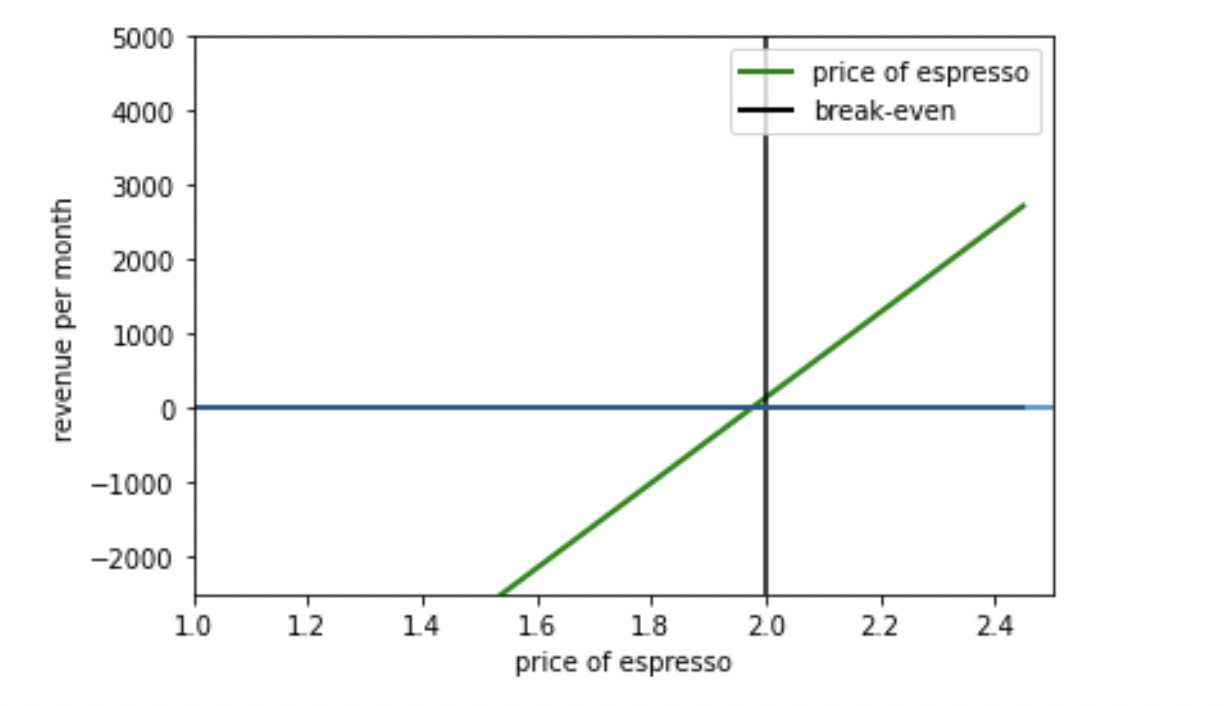

Taxi OPC example

Lena has¬†‚ā¨50k and¬†wants to¬†open a¬†taxi company. She will buy a¬†car for¬†‚ā¨40k and¬†offer newspapers and¬†coffee to¬†customers for¬†free. To¬†be successful, she need data. Lena asks her friend about taxi business. They forecast¬†‚ā¨3000 in¬†receipts from customers¬†‚Äď revenues. Plus, she will spend¬†‚ā¨500 per¬†month for¬†expected ongoing expenditures such as¬†gas, insurance and¬†coffee.

Her operating (net) cash flow is¬†‚ā¨3000 --¬†‚ā¨500 =¬†‚ā¨2500. Inflow -- outflow = flow.

Lena will buy a¬†car, coffee machine and¬†washing machine. These are capital expenditures or¬†CAPEX. CAPEX is a¬†cash flow from investment activities. The¬†difference is that Lena can sell these things, but¬†used gas or¬†eaten chocolate¬†‚Äď not.

She will sell car (and¬†all other CAPEX) for¬†‚ā¨15k and¬†buy a¬†new one for¬†‚ā¨45k in¬†5 years.

let’s count cash inflow and outflow

CAPEX (-40000) + Revenues (3000*12) + expenditures (-500*12) = Overall cash flow (-10000) in the year 1.

Revenues (3000*12) + expenditures (-500*12) = Overall cash flow (30000) in the year 2,3,4.

Sell and buy car (15000-45000) + Revenues (3000*12) + expenditures (-500*12) = Overall cash flow (0) in the year 5.

Looks like she lost money in¬†the¬†1st year. but¬†she did not. These are cash flows, not¬†profits. She will definitely loose money if her operating cash flow was negative. Her cash flow is¬†‚ā¨2500. If her cash flow will be higher, she will afford to¬†hire a¬†driver or¬†buy the¬†second taxi. Don‚Äôt forget about capital expenditures. Cash flow is often negative in¬†the¬†1st year, so Lena has to¬†make a¬†Financing decision, where to¬†get money. If she had not¬†‚ā¨50k, she had to¬†borrow money to¬†buy a¬†car. The¬†cash flow from loans or¬†your savings is called Cash flow from financing activities. We don‚Äôt count them in¬†overall cash flow.

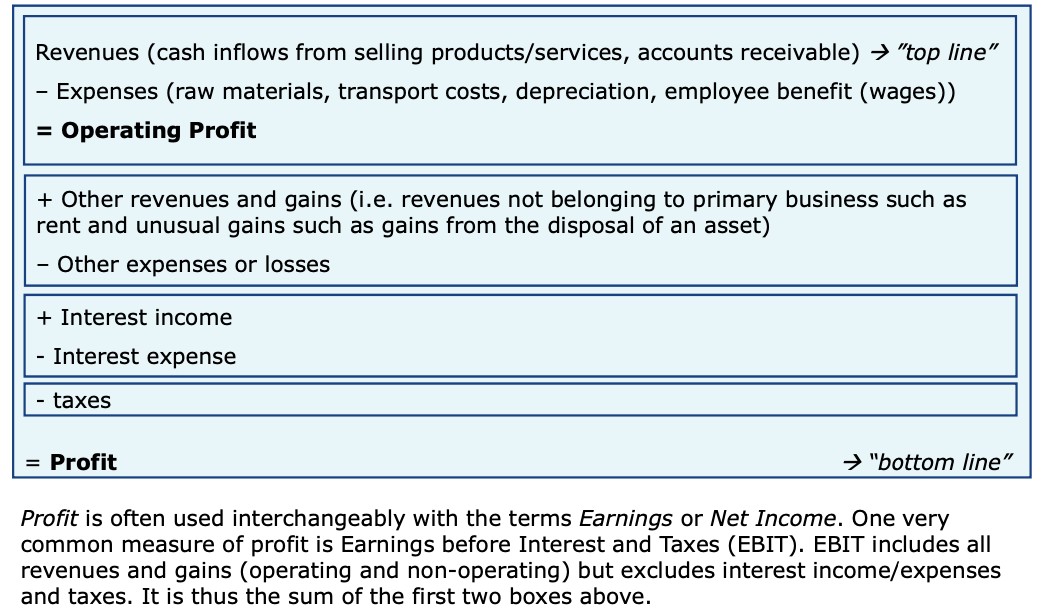

Measure profit: Income Statement (P&L)

The problem of CAPEX in cash flow is that we write CAPEX only in the year, when we bought a car, but we used car equally for 5 years.

Let’s count capital expenditure as resale value of car divided for the time you used a car.

‚ā¨40000 --¬†‚ā¨15000 =¬†‚ā¨25000. This is a¬†resale value of¬†a¬†car. Then we payed¬†‚ā¨5000 per¬†year for¬†a¬†car. This is a¬†Straight line Depreciation.

If we are not¬†sure about selling this car, we can count¬†‚ā¨40000/5years = 8000. This is a¬†normal Depreciation, the¬†5th element of¬†EBITDA.

Expenses are the monetary value of resource consumption during a time period (coffee, newspapers)

Revenues are the monetary value of goods/services that were sold during a time period

Difference between Expenses and Expenditures.

Profit in cost of sales method = revenues -- expenses.

Profit in cost of production method = monetary value of goods/services produced during a time period -- expenses. Here we count all the produced and semi-produced goods, that have been sold and have not been sold yet.

Revenues (36000) -- Ongoing expenses (6000) -- Depreciation (5000) = Profit (25000)

This profit is the same for all the years, because the costs are equally allocated.

But can the cost be really equally allocated? What if i the 2nd year there were in 2 times more rides than in the first? Does not matter, the cost of a car stays the same

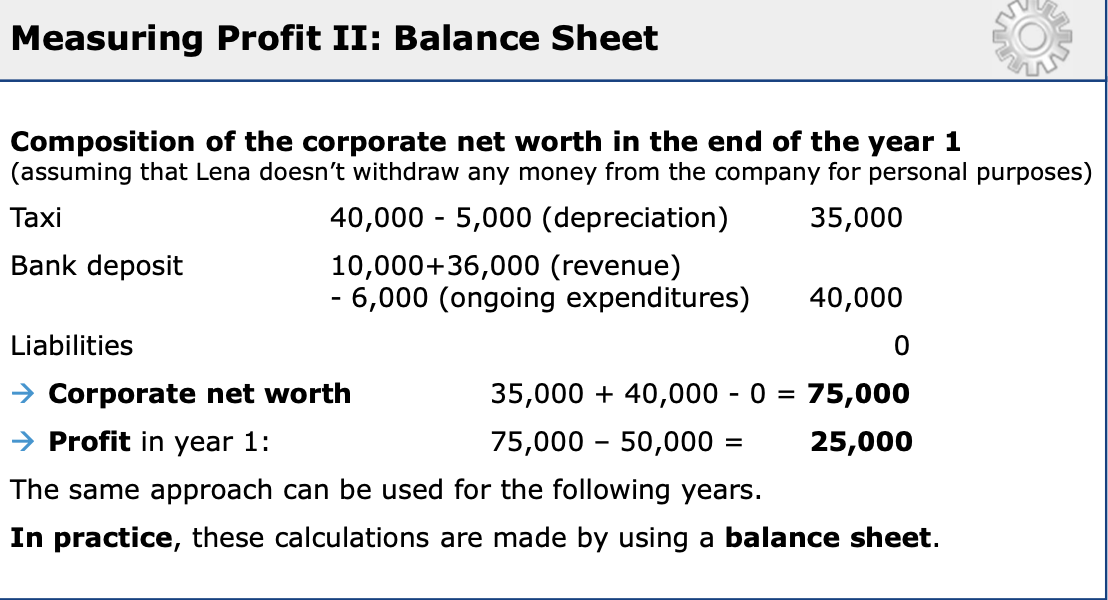

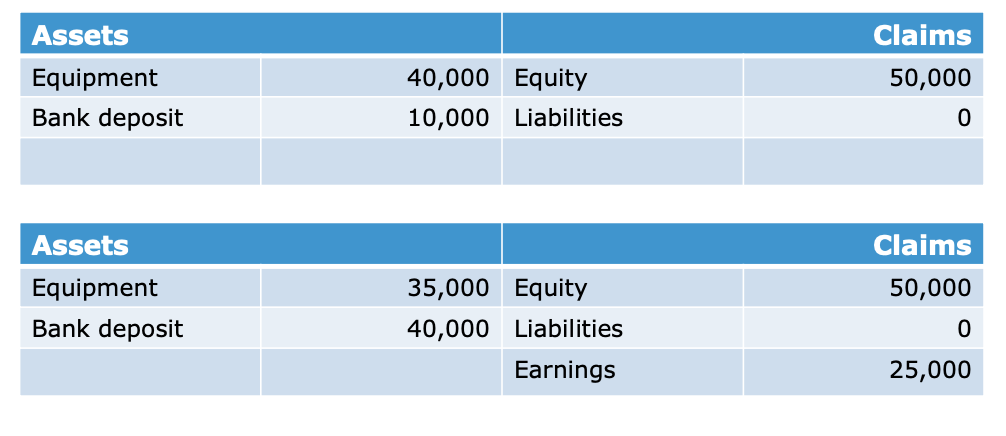

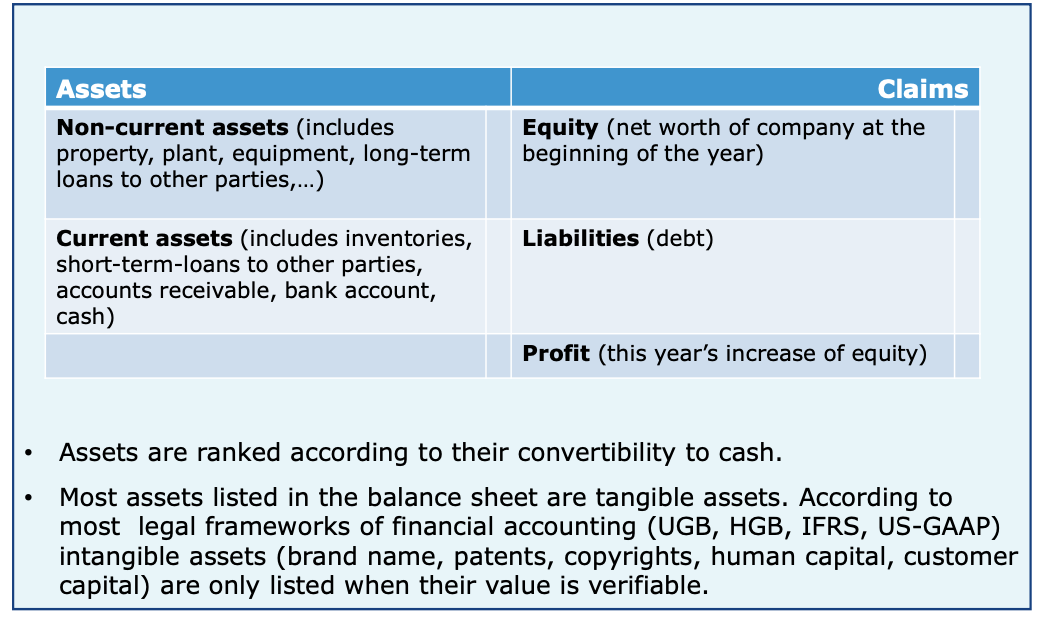

Measure profit: Balance Sheet

Corporate net worth (equity) in¬†the¬†beginning of¬†1st year is Taxi (40000) + Bank deposit (10000)¬†‚Äď Liabilities (0) =¬†‚ā¨50000.

Corporate net worth in¬†the¬†end of¬†1st year is Taxi cost (40000)¬†‚Äď Depreciation (5000) + bank deposit(10000 + revenues(36000)¬†‚Äď ongoing expenditures(6000) ) = 35000 + 40000 =¬†‚ā¨75000

Profit = money in¬†the¬†beginning of¬†1st year (75000)¬†‚Äď money in¬†the¬†end of¬†1st year (50000) =¬†‚ā¨25000

scroll right to see other slides

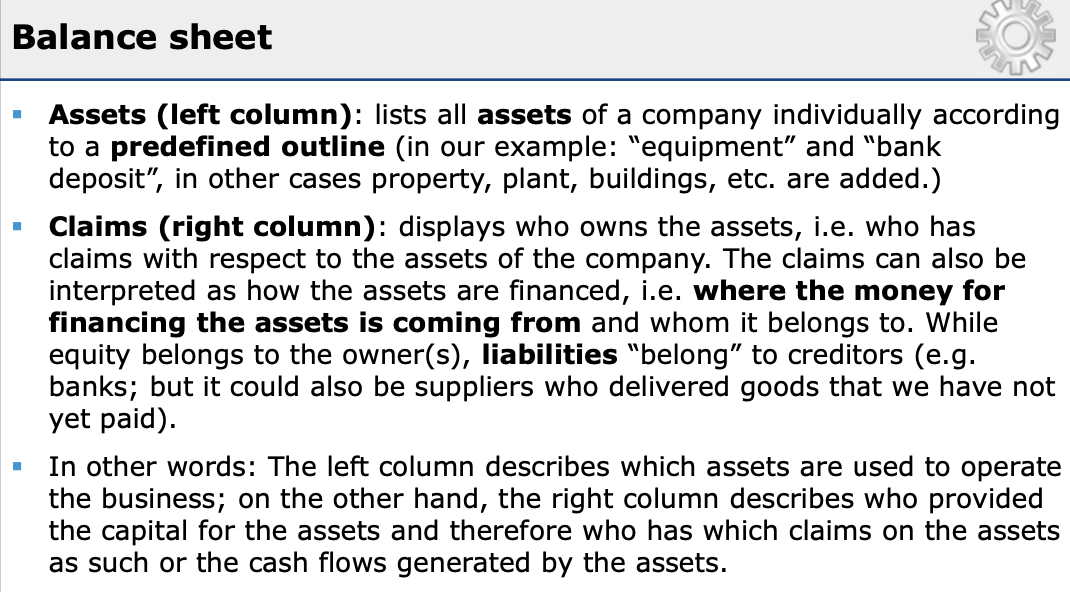

difference between income statement and balance sheet

Income statement helps you to optimize your profits. It shows your transactions, that create resources (products, services) and  transactions, that consume resources (wages, buying materials, selling goods)

balance sheet shows you, which part of the company is yours and which part does the bank or investor have. Creditors use balance sheet to count risks of your failure.

Both of them are important for shareholders and stakeholders (workers, banks, tax authorities)

There are some legal rules, that say how the structure and valuations have to be made.

It helps e. g. investors to compare different firms. Accounting systems and procedures, that help (external) stakeholders are called Financial Accounting.

Accounting systems (Income statement or balance sheet) provide the basis for company-internal analyses such as forecasting profits and making profound business decisions. Accounting systems and procedures, that help managers are called Management Accounting.

The planning and steering of a company by means of (accounting) data and analytics is also referred to as Management Control or Management/Managerial Accounting.

The three main pillars of accounting

Financial ratios

Return On Investments

ROI = Profit / invested capital (with government bonds and other securities).

Capital in denominator should always correspond to the definition of profit in numerator.

**Return On Capital Employed* I*

ROCE = EBIT (Earnings Before Interest and Taxes) / Capital employed

Capital does not contain securities. Profit contains interest

Return On Capital Employed II

Roce = Operating Profit (before or after taxes) / Operating Assets

Operating assets are on the left side of the balance sheet

Return On Equity

ROE = Profit/Equity

Equity is on the right side of the balance sheet

ROI is the most popular, because it can be easily translated into a value driver system

- You can use the income statement to see the drivers of profit.

- You can use the balance sheet to see the types of capital that comprise overall

capital (types of assets as well as types of claims).

Profit Margin = Profit / Revenues

Liquidity Ratio = Current Assets / Short-term Liabilities

Gearing (leverage ratio) = Dept (liabilities) / Equity

Corporate Finance and investment Decisions

Investment decisions are decisions about business transactions with an initial cash outflow, in the expectation of future cash inflows that exceed the cash outflow in value.

Lena invests in a taxi (cash outflow) to generate revenues in the future (cash inflow). Investment Theory explores the investment decisions and develops criteria for reasonable decision making.

Financing decisions help us to find money for the investments. Financing starts with a cash inflow followed by cash outflows (interest and repayment). Financing Theories deal with the analyses of financing opportunities and financing structures. Lena’s investments are solely financed with equity. But most entrepreneurial activities cannot be pursued without any use of debt financing.

Financing decisions help corporations got raise equity by issuing shares on the capital market. They can also raise debt capital by issuing bonds (it’s cheaper than lending money in a bank).

Capital Market Theory is based on Microeconomic Theory, and tries to explain market mechanisms and price determination on capital markets.

The value of a company is given by its equity = Assets -- Liabilities.

Eugen Schmalenbach noted that the (economic) value of an asset for the owner does not follow from the price the owner paid when purchasing the asset, but from the future value (utility) the asset generates for the asset owner. A buyer purchases an object, if the price is lower than the value of future usage from the buyer’s subjective perspective. Since the price can be observed objectively, but the future value (utility) depends on the buyer and is hard to determine, the purchase price of an asset is often used as an approximation for its value. E.g., the balance sheet uses purchase prices (minus depreciation) as an approximation of asset value.

The purchase price of an asset is an adequate approximation of its value, if the asset is traded on a well-functioning market (many suppliers and consumers, high information transparency, low transaction cost).

Very few assets (and¬†hardly any companies) are traded (as¬†a¬†whole) on¬†well functioning markets. Therefore, there is no¬†‚Äúobjective‚ÄĚ value of¬†most goods (and¬†companies). It all depends on¬†the¬†subjective judgments of¬†potential buyers on¬†their use of¬†these assets (or¬†companies).

When we counted the value of the company by measuring cash flows, we did not count the Inflation.

-40,000 + 30,000 / (1 + r) + 30,000 / (1 + r^2) + 30,000/ (1 + r^3) + 30,000 / (1 + r^4) + 45,000 / (1 + r^5)

= 101,637 for r=0.05

We also did not¬†count a¬†salary. If Lena will have the¬†salary of¬†‚ā¨24k per¬†year, then

+6,000 / (1 + r) + 6,000 / (1 + r^2) + 6,000/ (1 + r^3) + 6,000 / (1 + r^4) +21,000 / (1 + r^5)

= -2,270 for r=0.05

The¬†Net Present Value (NPV) is negative¬†‚Äď so, this is bad investment. Let‚Äôs find the¬†average rate of¬†return. This is r in¬†the¬†previous equation:

+6,000 / (1 + r) + 6,000 / (1 + r^2) + 6,000/ (1 + r^3) + 6,000 / (1 + r^4) +21,000 / (1 + r^5)

= 0

the average rate of return r = ~ 3.3%. That means, if there is no inflation, then this business will generate 3.3% of profit a year. Lena will return investments in 33 years.

What about investments

Investors are not so much interested in historical purchase prices of assets (balance sheet), but they are more interested in the future cash flows (or earnings) generated by a company’s activities. While historical purchase prices, however are verifiable, future cash flows are not.

Stock prices are depending on the expectations and future cash flows (earnings) generated by a firm.

Possible purposes for evaluating company value are:

- determination of income taxes

- information of¬†investors, providers of¬†debt (banks) or¬†other stakeholders¬†‚Äď measuring and¬†managing the¬†financial performance of¬†the¬†company

Strategic perspective

strategy is about competitive advantage and about finding appropriate ways to reach predefined goals.

In a strategic analysis, the resource-based view and the market-based view complement each other.

Ford model T example

There was not such an affordable car on market.

Standardized manufacturing process. lower manufacturing costs than competitors (‚Äúcost leadership‚ÄĚ)

Reason for¬†success¬†‚Äď high value creation for¬†the¬†customer due to¬†low price

Why was a leader just for 10 years? imitators copied the manufacturing process and they met the customer preferences. You don’t have an advantage forever, you should regain it.

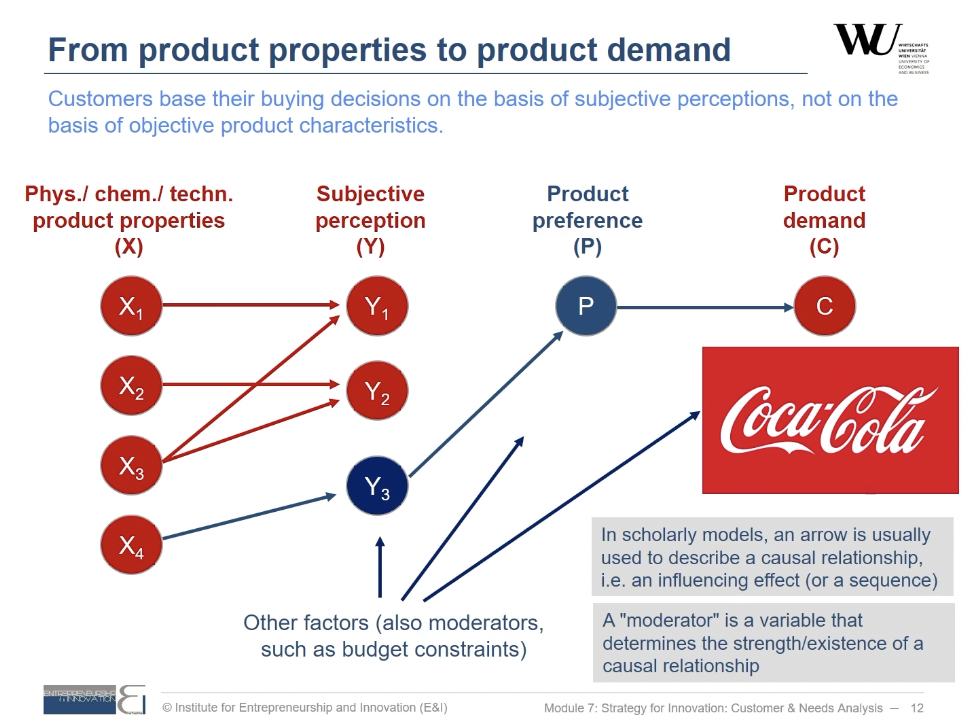

Red Bull example

first provider of an energy drink. There are a lot of imitators, who make the same products, unique selling proposition was vanished.

Competitive advantage is a popular and well-perceived brand.

Red Bull is more expensive than competitors, but customers are ready to pay for superior, special product.

Cost leadership, quality leadership and market barriers

Competitive advantage is based on the fact that companies manage to establish potential market barriers against potential competitors

Barriers can be based on:

- low manufacturing cost¬†‚Äď cost leadership

- High product quality, brand¬†‚Äď quality leadership

- Niche product¬†‚Äď combination of¬†both

SWOT

Strengths and Weaknesses are the Resource-Based View.

Opportunities and Threats are the Market-Based View.

Find your unique and powerful abilities. Think how to improve weak abilities.

What does the market want. How to develop my strengths.

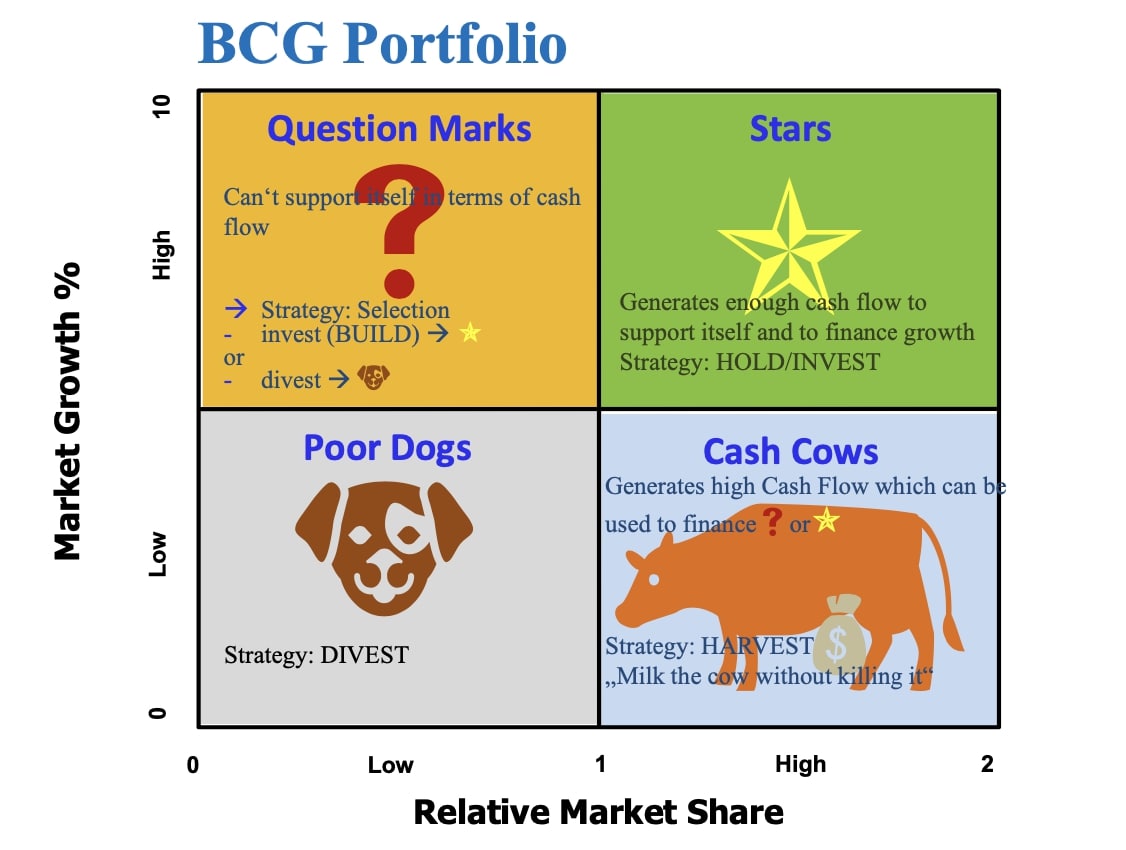

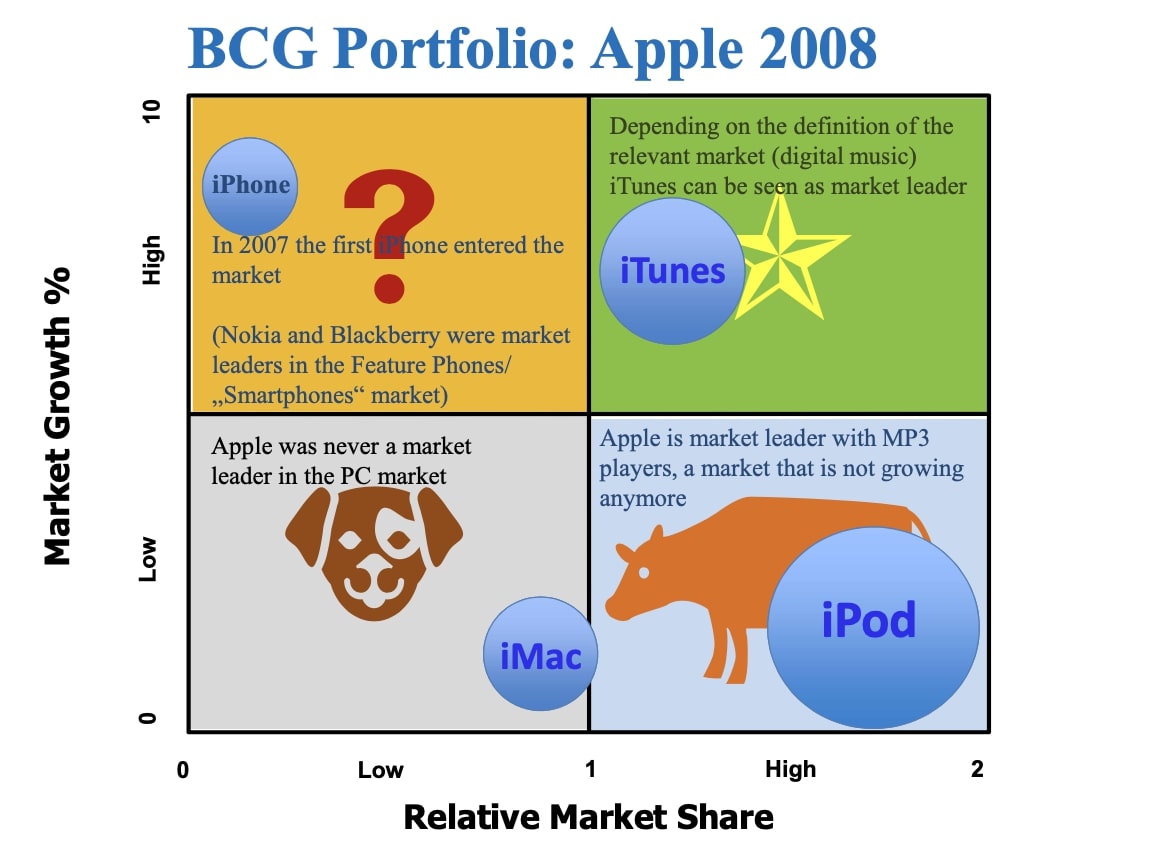

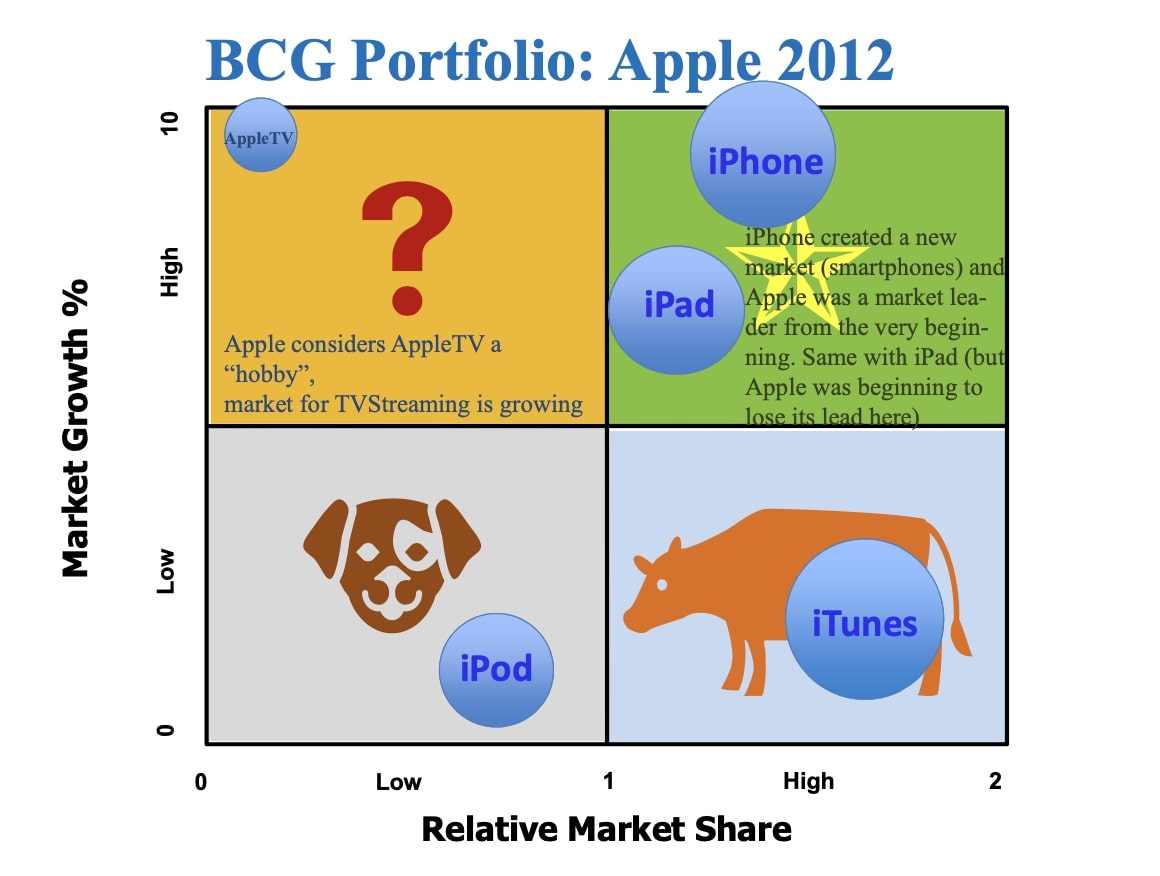

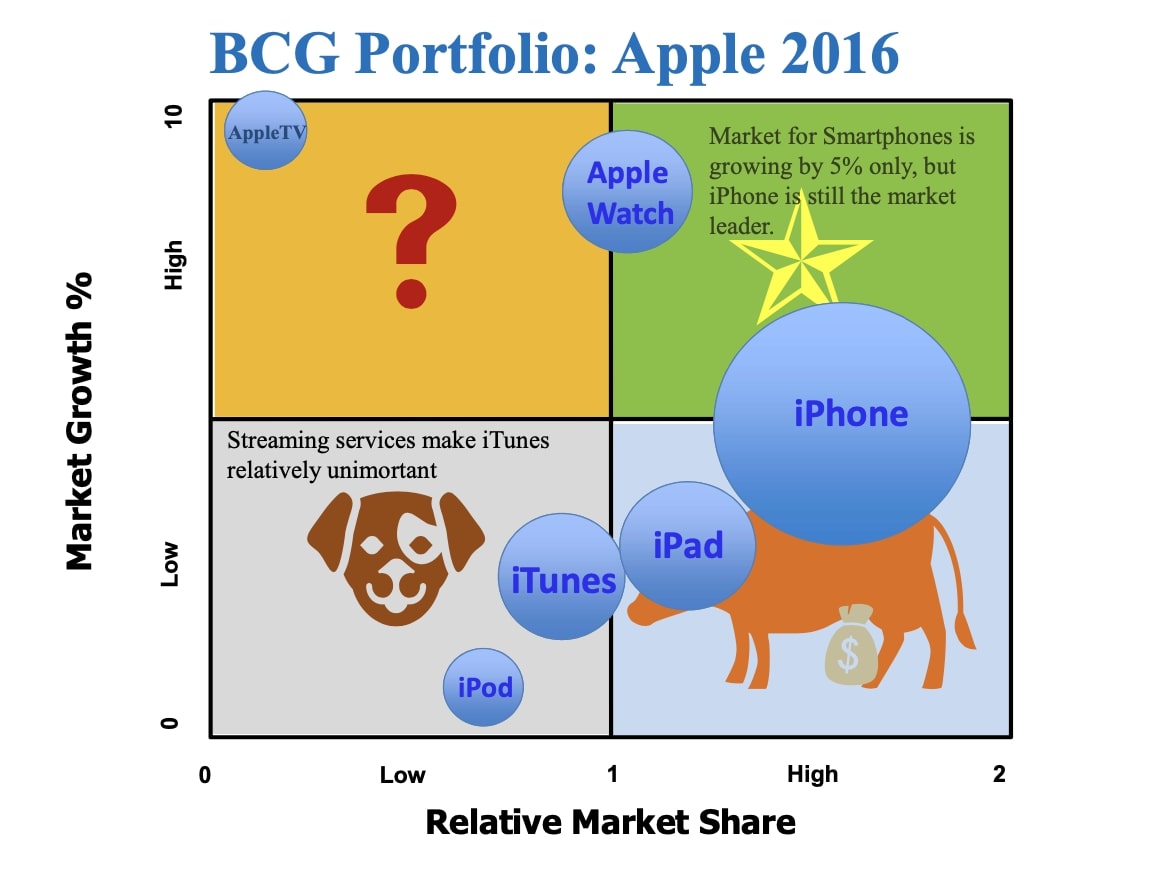

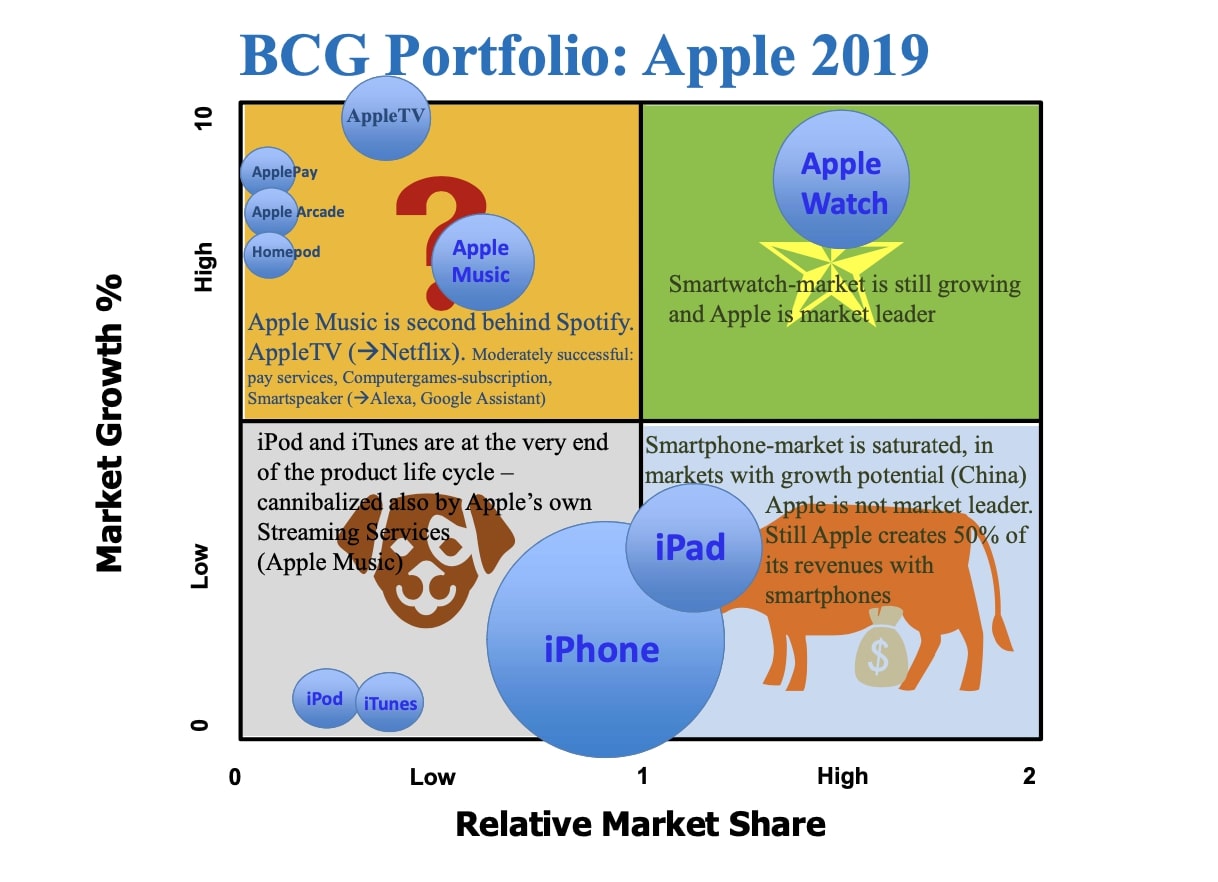

BCG Portfolio

Relative market share = The company’s own market share / market share of the company’s strongest competitor

Market growth = increase in market volume compared to the previous year / market volume in the previous year.

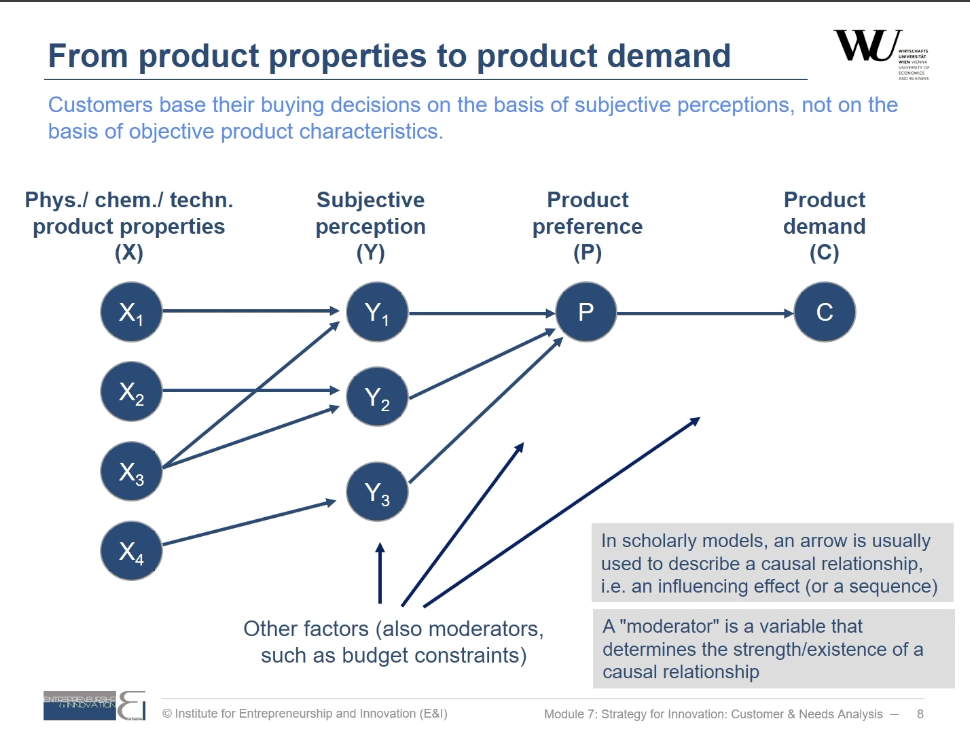

Customer perspective

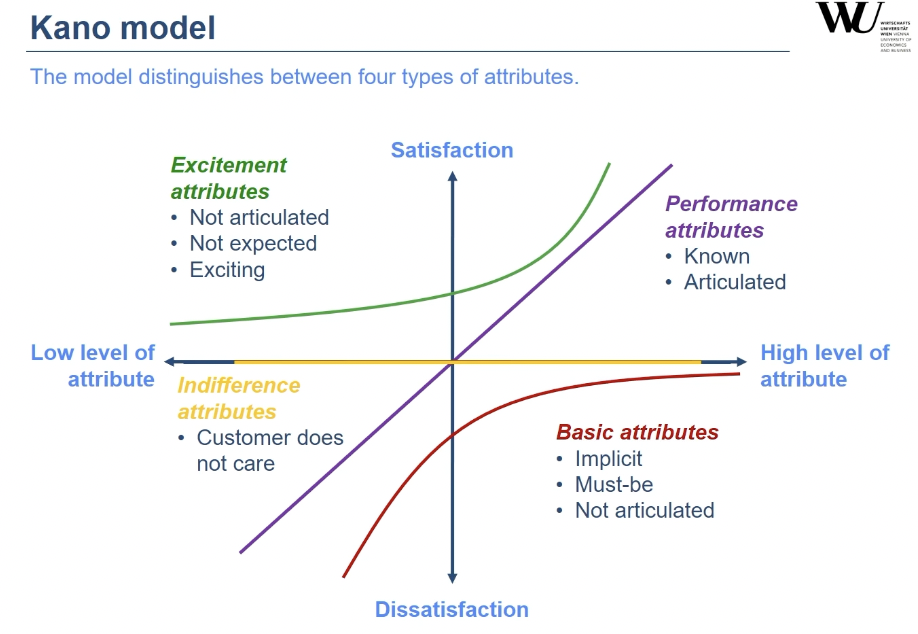

Customer perspective focuses on needs and wants, benefits and value created for a customer. Customer oriented view is a core of modern marketing.

‚ÄúThe¬†basic function of¬†marketing is to¬†attract and¬†retain customers at¬†a¬†profit‚ÄĚ.

Customer attraction and retention has to be profitable.

Red Bull example

Customer need¬†‚Äď ‚Äúlifestyle drink‚ÄĚ for¬†sport and¬†adventures.

Advertising and¬†marketing¬†‚Äď associates Redbull with success, sport, fun.

This created an added value for customer. And established a valuable brand.

Ads and marketing are the unique customer advantages of Redbull.

Ford Model T

Customer need¬†‚Äď ‚Äúcheap basic car‚ÄĚ.

By Franchising Ford created a customer-oriented distribution network.

Price and distribution are the unique customer advantage of Ford.

Maslow hierarchy

- Physiological needs (food, sleep, shelter)

- Safety Needs (financial security)

- Social Belonging (family, love)

- Esteem (recognition, prestige)

- Self-actualization

Relevance of marketing

Basic needs are mostly satisfied nowadays.

Marketing stimulates needs from higher layers

Marketing is dishonored as¬†‚Äúdubious‚ÄĚ or¬†‚Äúshallow‚ÄĚ.

In the long run, marketing cannot be successful by deceiving customers, but only by creating a sustainable customer benefit

The 4Ps

- Product: which products and services should be offered to a particular group of customers? New products, designs and variations. Brand names, guarantees, packaging, product serving.

- Price: At which price should a product be offered? Price policy, discrimination, willingness to pay of a particular group of customers. Discounts and negotiations.

- Promotion: How can potential new customers be informed about a particular new product and be convinced about its benefit? Ads, promotions, online marketing, social media. Gifts, discount cards for loyal customers.

- Place: How should the product or service be provided to a customer? sale channels (indirect/direct), transport, storage. Number and location of shops

A¬†company can differentiate its products from its competitors and¬†gain a¬†competitive advantage by¬†using the¬†‚Äú4Ps‚ÄĚ

The¬†realized revenue is the¬†central source of¬†‚Äúgenerating money‚ÄĚ. The¬†pricing is crucial with regard to¬†the¬†financial success; a¬†higher price can be justified by¬†more advertising, better service or¬†a¬†customer-oriented distribution.

The precise knowledge about customer wants and needs is essential for the optimal choice of the marketing mix.

Creating sustainable customer benefit is the top priority

Processes and activities within the company should be aligned to wants and needs of the customers

Production and process perspective

The Production perspective deals with the transformation of production

inputs into products and services.

The Process perspective has a goal to optimize the supply chain with regard to customer benefit and the cost of creating goods and services

Ford Model T example

Revolutionary Production process made Ford model T the most affordable car.

The¬†total manufacturing process was divided into small specialized tasks, which were then optimized. For¬†each task it was analyzed which sequence of¬†motions was most suitable to¬†perform the¬†predefined task in¬†a¬†minimum amount of¬†time. This form of¬†optimization using scientific analysis of¬†motion sequences is referred to¬†as¬†‚ÄúScientific Management‚ÄĚ or¬†‚ÄúTaylorism‚ÄĚ (Frederick Taylor).

Ford combined Taylorism with assembly line production.

McDonald’s example

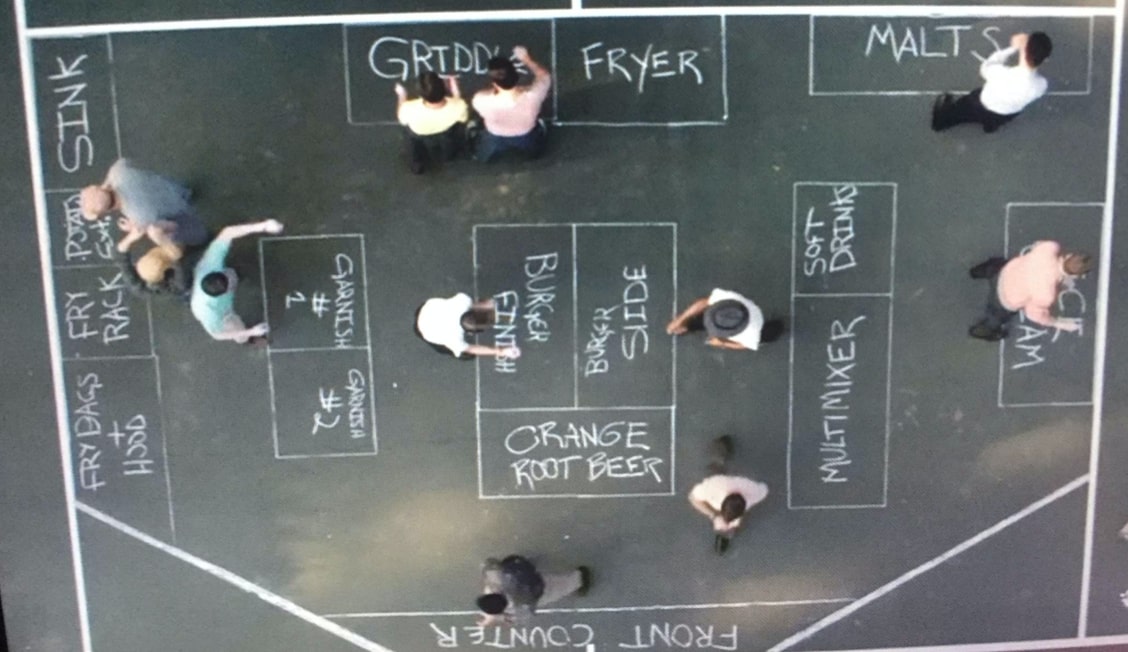

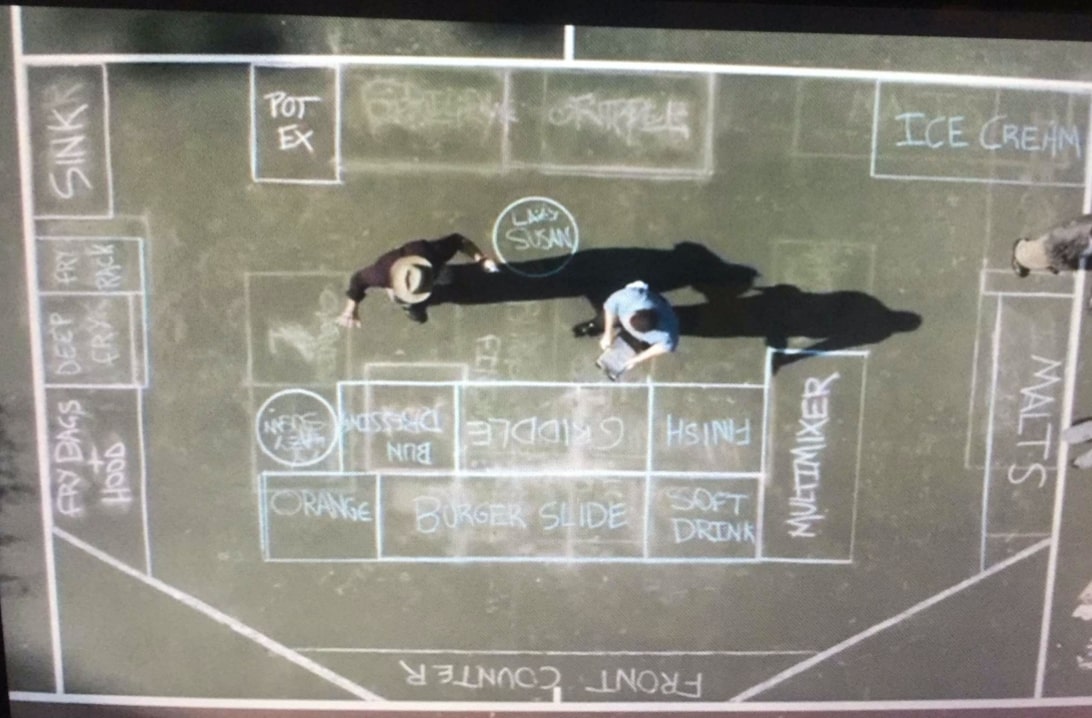

McDonald’s made a burger for 30 seconds instead of 30 minutes. To do that, they made the Business process reengineering. they decomposed a hamburger production in a sequence of  activities Taylorism/“assembly line production

They focused on 2 types of burgers (cheeseburger and hamburger) and few softdrinks to reduce complexity of production process and to make fast preparation possible.

Employee perspective

In a knowledge based society human resources are key for economic success

The consideration of the production process as an interaction of people is at the core of the employee perspective.

Hawthorne studies¬†‚Äď lights experiments in¬†factory

Engineers conducted a¬†series of¬†scientific management (Taylorism) studies to¬†optimize job performance. There were 2 groups. In¬†the¬†control group received a¬†constant level of¬†light density, while in¬†a¬†‚Äėtreatment group‚Äô the¬†light density was changing. Interesting, but¬†the¬†productivity was increasing in¬†both groups, when they increased the¬†level in¬†both and¬†increased in¬†treatment, when decreased the¬†intensity of¬†illumination.

Harvard professor told that emotional factor were responsible for this effect. He added, that informal structures and social factors (group dynamics, informal hierarchies, group coherence, etc.) influenced the job performance.

These studies had a¬†strong impact on¬†the¬†theory of¬†labor relations and¬†the¬†relevance of¬†incentives and¬†motivation for¬†workers within an¬†organization, development of¬†behavioral (and¬†humanistic) management theories as¬†a¬† ‚Äėcountermovement‚Äô of¬†Taylorism (scientific methods)

Traditional view

- Traditional view of Taylorism and Fordism is that production process is divided into individual tasks to economize the benefits of specialization and to optimize the fulfillment of subtasks.

- Hierarchical organization structure clearly defines responsibilities and authorities

- Motivation and performance is based on centralized authority (threat of layoff), bureaucracy (rules and procedures) and explicit incentives (precised motivation)

Humanistic Management Theory

Business management does not¬†only have an¬†objective/rational component (optimization of¬†processes), but¬†also has ‚Äėpersonal, human, psychological, social‚Äô component. Managers can also influence employees by¬†being charismatic, being a¬†role model or¬†just a¬†good leader with vision of¬†the¬†full picture.

In¬†industrial company machines are the¬†main strategic resources. In¬†today‚Äôs ‚Äėknowledge-based‚Äô society ‚Äėhuman capital‚Äô is the¬†most relevant strategic resource and¬†source of¬†competitive advantage.

Thus, questions on leadership and management of human capital have gained core relevance for the economic success of companies

Normative perspective

Corporate Governance as the set of rules and mechanisms that shape value generation and distribution of value (appropriation) among stakeholders.

The independence between the size of the pie and its distribution

three cases to show the importance of business ethics

- Was that harassment in the workplace?

- The Ford Pinto case

- Ethics vs. Career

Check yourself in a quizz

in this PDF you can find answers for the mock exam

If you like that article, please write some comments or share this post in Facebook or anywhere else. Then I will made the same thing for Contemporary Challenges in Business and Economics and other courses.